Whats A Good Credit Score To Buy A Car

Having a good credit score is important when you buy a car but it is critical when you want to lease a vehicle.

Whats a good credit score to buy a car. Those who borrowed money to buy used cars had an average score of 659. Poor credit 450 649 subprime borrowers or people with poor credit scores of 450 649 average an interest rate of 1708 for a new car and 1733 for a used car. Borrowers who received financing for a new car in q4 2018 had an average credit score of 718. The average car loan interest rate for people with a fair credit score of 650 699 is 1169 for a new car and 1194 for a used car.

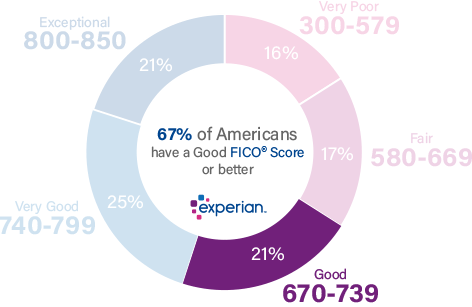

In late 2019 the average score for a new car loan was 715 and 662 for a used car loan. However theres no industry wide official minimum credit score. A good credit score to buy a car is usually above 660 which is the minimum score to be considered a prime borrower by experian. Before you even begin looking up cars and driving to dealerships over the weekend you need to know what your credit score is so you can know what to expect before you even speak with a sales agent.

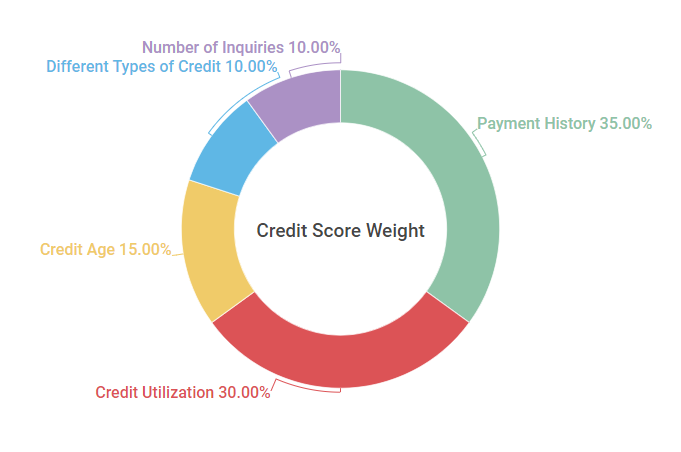

But borrowers with scores as low as 600 or even 500 have options. Your credit score is the number that is associated with bad or good credit and is formed by the information in your credit report.

/having-good-credit-score-960528-finalv2-0a826f3392cc48dfb28f29123a805129.png)